ECGC - Export Credit Guerentee Corporation

–> An Export Promotion Institution

– Provides credit risk covers to Exporters against non payment risks of the overseas buyers / buyer’s country in respect of the exports made.

– Provides credit Insurance covers to banks against lending risks of exporters

– Assessment of buyers for the purpose of underwriting

– Preparation of country reports

– International experience to enhance Indian capabilities

– An ISO organisation excelling in credit insurance services

Q. What risks are covered if we buy ECGC Cover?

COMMERCIAL RISKS

Insolvency of buyer/LC opening bank

Protracted Default of buyer

Repudiation by buyer

POLITICAL RISKS

War/civil war/revolutions

Import restrictions

Exchange transfer delay/embargo

Any other cause attributable to importing country

ECGC Could be termed as "CREDIT INSURANCE" ECGC will pay you only if your buyer fails to pay.

You should visit your nearest ECGC Office for more information https://www.ecgc.in/ (Government Body)

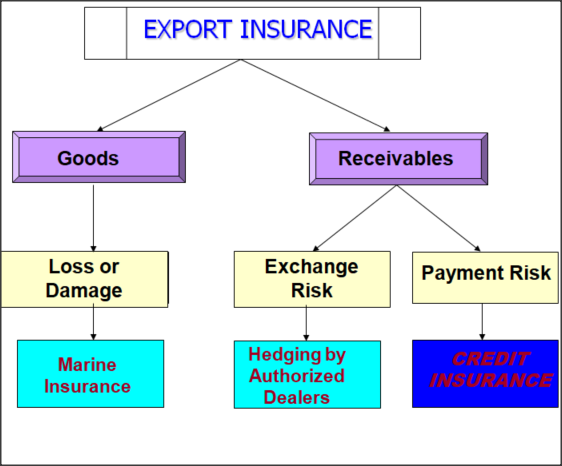

Q. Do ECGC Provide protection if there are quality issues or if our products get damaged in transit?

No, for products we have got marine insurance, marine insurance ICC Cover A would be helpful to us to get full claim if products get damaged in transit

Q. Do CHA / Shipping Line / Transport Company provide any help if goods are spoiled due to their misconduct?

A. No, CHA / Shipping Line / Transport Company will not provide any help but yes Airline provide his personal guarantee, generally, we don't buy any insurance for goods if we send goods via airline as all airline has to follow the norms of SDR, SDR is Special Drawing Rights, if goods reached in damaged condition airline will pay 20$ Per Kg at Max (based on Invoice value)

Q. Do ECGC, Insurance Co. Really help or its just a talk?

A. I really don't like to waste your & my time, they really do pay.

See the pics of my student Bhavin Sakhaya , MIRACLE OVERSEAS, received the money from ECGC, withdrew it from the bank via "Self Cheque" to pay to his farmers for garlic. His buyer in Sri Lanka turned out to be a fraud. His Partner Arpit & Bhavin both tried to called his fraud buyer "Highway Impex" & ask them to buy garlic from them again. I asked them why you are calling fraud buyer ?? why you want to deal with them? they replied me no worries sir, ECGC pays us we are happy...

Bhavin Counting money.....

My Students SDR Clam of AVD International

.jpeg)

Great but what about the loss people occurs due to currency?

In local trade, there is no security cover and protection for anything a loss a loss in local trade but in international business, we have got cover for every risk of loss. For currency, we could buy a forward contract from the bank, that you can discuss with bank forex manager while opening the bank an account. Suppose if we deal in USD & quote buyer at the rate of 1000 USD, while quoting 1 USD = 65 INR but in DP/DA/LC payment terms he will pay after we send the docs to our bank , and at that time he will pay bill of 1000 USD but currency rate might be 1 USD = 63 INR, in that case we will occur loss in conversion but if we have forward contact then bank will pay us difference of 2 INR. Its called heading the risk

Understand This....